HOW TO PLAY THE PROPERTY MELTDOWN IN FIVE CHARTS

Apartments might be a better bet for those hunting for distressed assets. Prices for multifamily apartment buildings have fallen by a fifth since March 2022. Some owners who paid top dollar for properties during the pandemic using short-term, floating-rate debt may be forced to sell if mortgage repayments become unmanageable when their interest rate hedges expire… Read More

The Wall Street Journal, Aug 30, 2023

The Clearest Sign yet That Commercial Real Estate is in Trouble

Foreclosures are surging in an opaque and risky corner of commercial real-estate finance, offering one of the starkest signs yet that turmoil in the property market is worsening. Lenders this year have issued a record number of foreclosure notices for high-risk property loans, according to a Wall Street Journal analysis… Read More

The Wall Street Journal, Nov 13, 2023

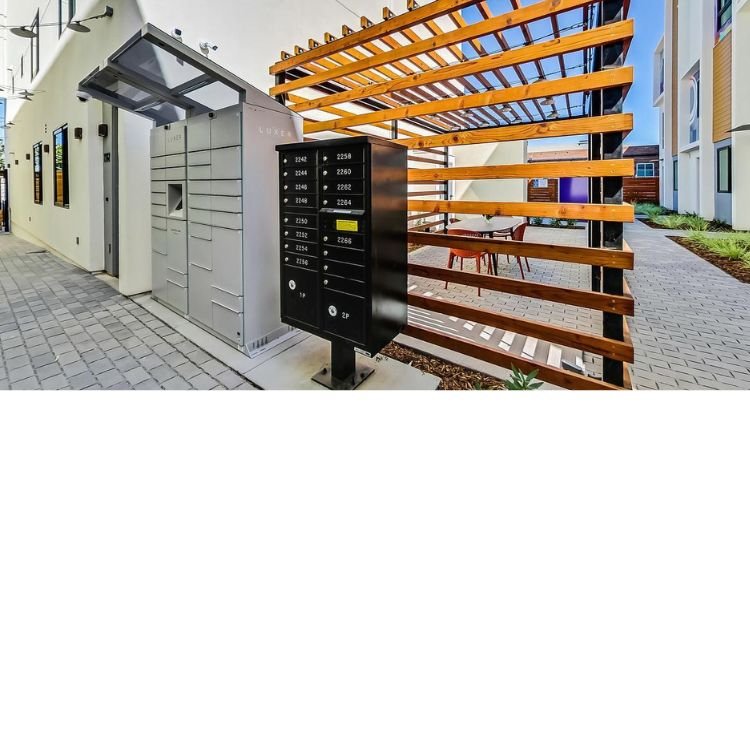

'Granny flats' play surprising role in easing California's housing woes.

More than 23,000 ADU permits were issued in California last year, compared with fewer than 5,000 in 2017 — which was around when ADU permitting began to take off thanks to legislative and regulatory changes in the state. The state now requires faster permit approval by localities, and establishes that cities must allow ADUs of at least 850 square feet...Read More

The Washington Post, May 21, 2023

How will the IRA impact commercial real estate?

While you’ve no doubt heard about the Inflation Reduction Act (IRA), it may have evaded your sphere of concern as something only relevant to those focused on battling economic inflation or combating climate change. You may want to take a second look, though, as the bill has major considerations for the commercial real estate (CRE) industry… Read More

Globest.com, Sep 21, 2022