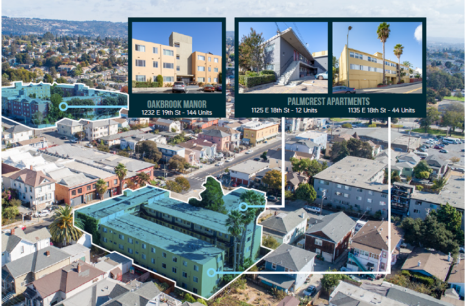

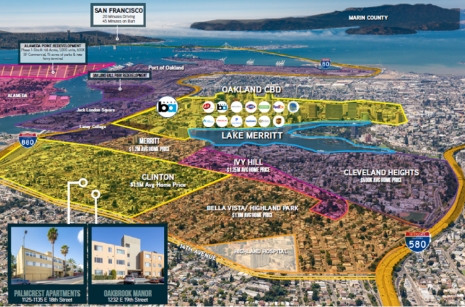

In our typical value-add strategy, we look for deals in attractive markets. These areas include urban centers with a lack of affordable housing options, an underserved demographic, and contrarian market sentiment. This was consistent for oakbrook and palmcrest, which are situated in close proximity to lake merritt.

We look for sites with strong market fundamentals including: access to mass transit, proximity to entertainment and recreational options, large employment and education opportunities, and excess space to increase the property's density. This location met this criteria with mass transit options, outdoor recreation, bars and restaurants as well as major employment opportunities.

Our first order of business, upon acquisition, is to improve the quality and longevity of the building by updating the existing units, improving common areas, adding functional amenities like fitness options and bike storage, adding tech-enabled access control and package storage, and upgrading the building infrastructure (roof replacement, seismic support, etc. ) as needed. This project was unique in that it had a low occupancy rate (63%) which gave us the ability to improve a substantial portion of the building from the onset. This improved net operating income in the first year, which is exceptionally fast. The Addition of new amenities, like a functional fitness center, was accomplished by converting existing underutilized square footage. Improvements to the common areas and building exterior were also implemented as shown below.

A fresh coat of paint can go a long way. We upgraded the building exterior, modernized the lobby, converted unused space into a fitness center, and refreshed the other common area elements. These improvements gave the building a better sense of arrival and a more modern feel.

As mentioned, the building was acquired at very low occupancy, with over 35% of the units vacant. This allowed us to upgrade and modernize the vacant units in the building and ultimately the remaining units as leases turned over.

One of the primary focuses of our value-add strategy is to increase the unit count, and ultimately the density of our projects, by adding Accessory Dwelling Units or "ADUs" where possible. By leveraging state legislation, we are able to build new units on existing properties and subdivide large, inefficient unit layouts to add new studio apartments.

We converted 34 unused garage spaces into 17 well-appointed studio apartments.

As part of the unit improvements, we added new electric systems and efficiencies to them. This includes new electric appliances, upgraded service systems, new wiring, and new insulation. Using the inflation reduction act, these activities will qualify for new rebate programs, which we are anticipating to reduce the overall cost of improvements by up to $14,000 per unit. These rebates will also apply to the new units we add to the building. In addition to improving the energy efficiency of the building, we will be adding a new solar power system to offset a portion of the building's energy consumption. Because many of the improvements at this project took place prior to the passage of the IRA, we were not able to initially capture these rebates but will over the course of the hold. Part of the inflation reduction act allows us to secure new tax credits for the creation of solar power, which will reduce the installation costs of those systems.