GROUND-UP DEVELOPMENT

- Linden Case Study

Linden Case Study

SUMMARY

The Linden is a small-scale representation of Riaz Capital’s go-forward business strategy: the micro-living apartment complex. Through an adept understanding of policy and a skillful approach to value creation, we are committed to what we believe amounts to an emerging asset class.

The Linden is a mark of success. The project was 70% pre-leased at launch on October 1, 2021 and achieved stabilization with 100% occupancy within 30 days of opening. The popularity of the building stayed consistent throughout the pandemic, retaining an average occupancy of 95% in its first year.

The Linden is the first of many projects set to provide the urban workforce with attainable, premium quality housing in the

urban areas they live and work in. With a per-unit development cost of roughly half that of other Bay Area projects and full lease-up within 30 days even during the COVID-19 pandemic, we proudly present the Linden as a micro-living development success story. Having proven the feasibility of the micro-living model with the Linden, we are moving forward with building larger, mid-rise projects utilizing a similar unit model.

Development Facts

| THE LINDEN | MARKET AVERAGE | |

|---|---|---|

| Per unit Dev. Cost | $232,500 | $573,569* |

| Avg. Rent Per Unit | $1,868 | $2,453** |

*Based on a model produced by the Terner Center for Housing Innovation (Making it Pencil: Math Behind Housing Development)

**Oakland studio average

Target Customer Facts

32

Average Age

$60K - $100K

Average Income Range

690

Average Credit Score

THE CHALLENGE

Single, middle-income professionals who make up the urban workforce are hard-pressed to find affordable, private accommodations in the high-value real estate markets they call home. These urban residents have grown to become a substantial share of every metro area’s population, and this is especially true in the Bay Area. Our estimates place 820,000 people in the Bay Area alone making between $65K and $100K per year: a substantial market to cater to. At the same time, the urban thinktank SPUR estimates that by 2070, the Bay Area will need to produce 243,000 units of housing within the price range of households making between $79K and $119K annually to meet the housing needs of the region.1

Particularly in the Bay Area, we find that the single urban professional has a stable and predictable income, high credit score, and a strong desire to live in comfortable, private accommodations without roommates. That said, at their price point they can only have two out of three aspects of desirable housing at the expense of the third: privacy, size, and location.

On a limited budget, housing is a game of tradeoffs. The specific needs of these generally young and single people, in contrast to the needs of previous generations, amount to high demand for small, well-located, and private rental units at the expense of square footage. However, the crippling housing crisis in California and the failure of the real estate industry to recognize the needs of this demographic mean that there is currently no purpose-built asset class to serve this demographic.

Riaz Capital set out to create a model for housing the urban workforce comfortably, affordably, and profitably. With the Linden, we created a proof of concept for what we have come to call “micro-living.”

180%-120% of the 2018 area median income of $99K, assuming 2.75 people per household.

APPROACH

With decades of experience across the gamut of residential Bay Area real estate – from coliving to traditional multifamily – Riaz Capital was in a special position to create a model of micro-living for the masses.

We set out to create a property that evoked a luxury aesthetic at a price point accessible to the average median-income professional, all while providing the essential amenities the target demographic desires. By compromising on unit size, we were able to use the same high-quality finishes and materials as in our higher-end offerings while remaining within the established rental price point. Mirroring luxury properties was key to the success of this project; if we wanted to market the Linden to median-income professionals, we needed to make the property something anyone would be proud to call home.

In our effort to deliver a project at roughly half the per-unit development cost of other projects in the Bay Area ($232,738 vs. the average $573,569), we had to optimize building efficiency and density. To do this, we outlined and adhered to five principles of efficient building. With our vision established and financial models in hand, we set out to implement our first micro-living project.

RESULTS

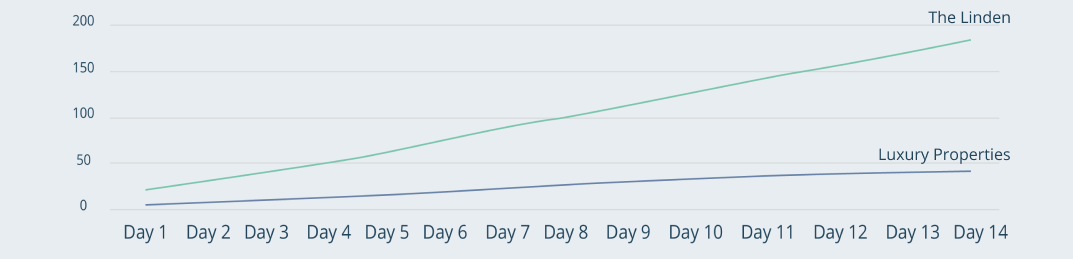

Now complete and stabilized, The Linden has been an outstanding success, validating our vision of building and leasing our micro-studio strategy. We began pre-leasing The Linden on August 25th, 2020, in the depths of the pandemic. Over the first 2 weeks of pre-leasing, we received over 4 times more leads at The Linden than our luxury property, Hannah Park.

Hannah Park is a brand-new luxury apartment offering, which is quite different from the small format studios at The Linden. However, both sport the same high-quality finishes. The major driver for our difference in leasing traffic is price point: our target demographic for the Linden is particularly price sensitive and thus attracted to the property’s competitive, affordable rents.

The Linden was 70% leased in pre-leasing, and 100% leased within 30 days of opening. In the first year, the project had 95% average occupancy, surpassing our original leasing targets.

INVEST IN THE MICRO-LIVING STRATEGY

Beating original leasing targets is always an excellent result but doing so in a pandemic-affected economy that was not incorporated into the original underwriting is particularly exceptional. The success of the Linden has been strong assurance for the success of our strategy.

If you are interested in learning more about Ozone Fund III, our latest opportunity zone fund, please fill out your information below to get in contact with us.